Overview

Monetary policy rests on the relationship between the rates of

interest in an economy, that is, the price at which money can be

borrowed, and the total supply of money. Monetary policy uses a variety

of tools to control one or both of these, to influence outcomes like economic growth, inflation, exchange rates with other currencies and unemployment.

Tuesday, December 13, 2011

ICT

INTRODUCTION

Managing

Information Communication Technology (ICT) resources will enable organizations

to get more out of their current equipment and also to make better decisions

around the purchase of new equipment and ICT developments

Child Labour

Introduction

The most innocent phase in human life is the

childhood. It is that stage of life when the human foundations are laid for a

successful adult life. It is the phase when we are carefree, fun-loving,

learning, playing… Go back into your childhood and for most of us, there are

beautiful memories. And how wonderful to have grown up with such carefree

abandonment while we had parents, grandparents and others looking after us.

But, this is the story of not too many children.

STEPS FOR REPORT WRITING

INTRODUCTION

The

final and a very important step in a research study are to write its report.

The research report is a means for communicating our research experiences to

others and adding them to the fund of knowledge. After collecting and analyzing the data, the

researcher has to accomplish the task of drawing inference followed by report

writing. This has to be done very carefully, otherwise misleading conclusions

may be drawn and the whole purpose of doing research may get vitiated.

PRIMARY MEMORY

INTRODUCTION

Computers are used to perform

various tasks in science, engineering, business, education, entertainment and

many other human endeavors. They work at high speed, are able to handle large

amounts of data with great accuracy, and have the ability to carry out

specified sequence of operations (Program) without human intervention. The CPU

handles the processing of data and after processing, presents the results with

the help of output devices. However, to process the data and to store the

output, computers require memory.

HYPOTHESIS

INTRODUCTION

A

hypothesis is a preliminary or tentative explanation or postulate by the

researcher of what the researcher considers the outcome of an investigation

will be. It is an informed/educated guess.

It indicates the expectations of the

researcher regarding certain variables. It is the most specific way in

which an answer to a problem can be stated.

TELE TUTORING

INTRODUCTION

The important technologies in education that have

combined to make the communication revolution and information age a challenging

era for educators: Tele conferencing, Tele lecture, Tele tutorial, Tele

seminar, etc.

MODELS OF TEACHING

INTRODUCTION

Development of models of teaching is one of the recent innovations in

teaching. An important purpose of discussing models of teaching is to assist

the teacher to have a wide range of approaches for creating a proper interactive

environment for learning.

SYSTEM APPROACH

The instructional process has become so

complex these days because of the shift in technological focus from the

classroom to curriculum planning. The number of objectives to be reached as a

result of the instructional programme has increased.

STEPS TO EMOTIONAL CONTROL

The following is an outline of a plan for implementing the information

contained in this report. The order in which you take these steps is not

important. If you tackle the items on this list with sincerity and seriousness,

you will be well on your way to achieving emotional control.

INTELLIGENT TUTORING SYSTEM

INTRODUCTION

Reforms Developments in Indian Capital Market

Recent Developments in Capital Market of India

The Indian capital market has witnessed major reforms in the decade of 1990s and there after. It is on the verge of the growth.Thus, the Government of India and SEBI has taken a number of measures in order to improve the working of the Indian stock exchanges and to make it more progressive and vibrant.

Economic Reforms of the Banking Sector In India - Brief

Economic Reforms of the Banking Sector In India

Indian banking sector has undergone major changes and reforms during economic reforms. Though it was a part of overall economic reforms, it has changed the very functioning of Indian banks. This reform have not only influenced the productivity and efficiency of many of the Indian Banks, but has left everlasting footprints on the working of the banking sector in India.Quality Control Total Quality Management TQM Quality Circles

1. Introduction to Quality

Every manufacturing organisation is concerned with the quality of its product. While it is important that quantity requirements be satisfied and production schedules met, it is equally important that the finished product meet established specifications.

Every manufacturing organisation is concerned with the quality of its product. While it is important that quantity requirements be satisfied and production schedules met, it is equally important that the finished product meet established specifications.

Role of Stock Exchanges In Capital Market of India

Role of Stock Exchanges In Capital Market of India

Role of Stock Exchanges In Capital Market of India

Stock Exchanges play a crucial role in the consolidation of a national economy in general and in the development of industrial sector in particular. It is the most dynamic and organised component of capital market. Especially, in developing countries like India, the stock exchanges play a cardinal role in promoting the level of capital formation through effective mobilisation of savings and ensuring investment safety.

Lets study the role of stock exchanges in capital market of India :-

1. Effective Mobilisation of savings

1. Effective Mobilisation of savings

Stock exchanges provide organised market for an individual as well as institutional investors. They regulate the trading transactions with proper rules and regulations in order to ensure investor's protection. This helps to consolidate the confidence of investors and small savers. Thus, stock exchanges attract small savings especially of large number of investors in the capital market.

2. Promoting Capital formation

2. Promoting Capital formation

The funds mobilised through capital market are provided to the industries engaged in the production of various goods and services useful for the society. This leads to capital formation and development of national assets. The savings mobilised are channelised into appropriate avenues of investment.

3. Wider Avenues of investment

3. Wider Avenues of investment

Stock exchanges provide a wider avenue for the investment to the people and organisations with investible surplus. Companies from diverse industries like Information Technology, Steel, Chemicals, Fuels and Petroleum, Cement, Fertilizers, etc. offer various kinds of equity and debt securities to the investors. Online trading facility has brought the stock exchange at the doorsteps of investors through computer network. Diverse type of securities is made available in the stock exchanges to suit the varying objectives and notions of different classes of investor. Necessary information from stock exchanges available from different sources guides the investors in the effective management of their investment portfolios.

4. Liquidity of investment

4. Liquidity of investment

Stock exchanges provide liquidity of investment to the investors. Investors can sell out any of their investments in securities at any time during trading days and trading hours on stock exchanges. Thus, stock exchanges provide liquidity of investment. The on-line trading and online settlement of demat securities facilitates the investors to sellout their investments and realise the proceeds within a day or two. Even investors can switch over their investment from one security to another according to the changing scenario of capital market.

5. Investment priorities

5. Investment priorities

Stock exchanges facilitate the investors to decide his investment priorities by providing him the basket of different kinds of securities of different industries and companies. He can sell stock of one company and buy a stock of another company through stock exchange whenever he wants. He can manage his investment portfolio to maximise his wealth.

6. Investment safety

6. Investment safety

Stock exchanges through their by-laws, Securities and Exchange Board of India (SEBI) guidelines, transparent procedures try to provide safety to the investment in industrial securities. Government has established the National Stock Exchange (NSE) and Over The Counter Exchange of India (OTCEI) for investors' safety. Exchange authorities try to curb speculative practices and minimise the risk for common investor to preserve his confidence.

7. Wide Marketability to Securities

7. Wide Marketability to Securities

Online price quoting system and online buying and selling facility have changed the nature and working of stock exchanges. Formerly, the dealings on stock exchanges were restricted to its head quarters. The investors across the country were absolutely in dark about the price fluctuations on stock exchanges due to the lack of information. But today due to Internet, on line quoting facility is available at the computers of investors. As a result, they can keep track of price fluctuations taking place on stock exchange every second during the working hours. Certain T.V. Channels like CNBC are fully devoted to stock market information and corporate news. Even other channels display the on line quoting of stocks. Thus, modern stock exchanges backed up by internet and information technology provide wide marketability to securities of the industries. Demat facility has revolutionised the procedure of transfer of securities and facilitated marketing.

8. Financial resources for public and private sectors

8. Financial resources for public and private sectors

Stock Exchanges make available the financial resources available to the industries in public and private sector through various kinds of securities. Due to the assurance of liquidity, marketing support, investment safety assured through stock exchanges, the public issues of securities by these industries receive strong public response (resulting in oversubscription of issue).

9. Funds for Development Purpose

9. Funds for Development Purpose

Stock exchanges enable the government to mobilise the funds for public utilities and public undertakings which take up the developmental activities like power projects, shipping, railways, telecommunication, dams & roads constructions, etc. Stock exchanges provide liquidity, marketability, price continuity and constant evaluation of government securities.

10. Indicator of Industrial Development

10. Indicator of Industrial Development

Stock exchanges are the symbolic indicators of industrial development of a nation. Productivity, efficiency, economic-status, prospects of each industry and every unit in an industry is reflected through the price fluctuation of industrial securities on stock exchanges. Stock exchange sensex and price fluctuations of securities of various companies tell the entire story of changes in industrial sector.

11. Barometer of National Economy

11. Barometer of National Economy

Stock exchange is taken as a Barometer of the economy of a country. Each economy is economically symbolized (indicators) by its most significant stock exchange. New York Stock Exchange, London Stock Exchange, Tokyo Stock Exchange and Bombay Stock Exchange are considered as barometers of U.S.A, United Kingdom, Japan and India respectively. At both national and international level these stock exchanges represent the progress and conditions of their economies.

Thus, stock exchange serves the nation in several ways through its diversified economic services which include imparting liquidity to investments, providing marketability, enabling evaluation and ensuring price continuity of securities.

Powers of SEBI - Securities and Exchange Board of India

Powers of SEBI

The important powers of SEBI (Securities and Exchange Board of India) are:-

Figure 1. Image or picture of SEBI's official logo.

SEBI has wide powers regarding the stock exchanges and intermediaries dealing in securities. It can ask information from the stock exchanges and intermediaries regarding their business transactions for inspection or scrutiny and other purpose.

SEBI has been empowered to impose monetary penalties on capital market intermediaries and other participants for a range of violations. It can even impose suspension of their registration for a short period.

SEBI has a power to initiate actions in regard to functions assigned. For example, it can issue guidelines to different intermediaries or can introduce specific rules for the protection of interests of investors.

SEBI has power to regulate insider trading or can regulate the functions of merchant bankers.

For effective regulation of stock exchange, the Ministry of Finance issued a Notification on 13 September, 1994 delegating several of its powers under the Securities Contracts (Regulations) Act to SEBI.

SEBI is also empowered by the Finance Ministry to nominate three members on the Governing Body of every stock exchange.

SEBI is also empowered to regulate the business of stock exchanges, intermediaries associated with the securities market as well as mutual funds, fraudulent and unfair trade practices relating to securities and regulation of acquisition of shares and takeovers of companies.

The important powers of SEBI (Securities and Exchange Board of India) are:-

Figure 1. Image or picture of SEBI's official logo.

1. Powers relating to stock exchanges & intermediaries

SEBI has wide powers regarding the stock exchanges and intermediaries dealing in securities. It can ask information from the stock exchanges and intermediaries regarding their business transactions for inspection or scrutiny and other purpose.

2. Power to impose monetary penalties

SEBI has been empowered to impose monetary penalties on capital market intermediaries and other participants for a range of violations. It can even impose suspension of their registration for a short period.

3. Power to initiate actions in functions assigned

SEBI has a power to initiate actions in regard to functions assigned. For example, it can issue guidelines to different intermediaries or can introduce specific rules for the protection of interests of investors.

4. Power to regulate insider trading

SEBI has power to regulate insider trading or can regulate the functions of merchant bankers.

5. Powers under Securities Contracts Act

For effective regulation of stock exchange, the Ministry of Finance issued a Notification on 13 September, 1994 delegating several of its powers under the Securities Contracts (Regulations) Act to SEBI.

SEBI is also empowered by the Finance Ministry to nominate three members on the Governing Body of every stock exchange.

6. Power to regulate business of stock exchanges

SEBI is also empowered to regulate the business of stock exchanges, intermediaries associated with the securities market as well as mutual funds, fraudulent and unfair trade practices relating to securities and regulation of acquisition of shares and takeovers of companies.

Services of Stock Exchange to Investors and Companies

Services given by Stock Exchange to Investors ↓

Services given by Stock Exchange to Investors ↓

Image Credits © A7design1

- Provides liquidity to investement : Stock exchange provides liquidity (i.e easy convertibility to cash) to investment in securities. An investor can sell his securities at any time because of the ready market provided by the stock exchange. Stock exchange provides easy marketability to corporate securities.

- Provides collateral value to securities : Stock exchange provides better value to securities as collateral for a loan. This facilitates borrowing from a bank against securities on easy terms.

- Offers opportunity to participate in the industrial growth : Stock exchange provides capital for industrial growth. It enables an investor to participate in the industrial development of the country.

- Estimates the worth of securities : Stock exchange provides the facility of knowing the worth (i.e true market value) of investment due to quotations (i.e price list) and reports published regularly by the exchange. This type of information guides investors as regards their future investments. They can purchase or sell securities as per the price trends (i.e latest price value) in the market.

- Offers safety in corporate investment : An investor can invest his surplus money (i.e extra money) in the listed securities with reasonable safety. The risk in such investment is reduced considerably due to the supervision of stock exchange authorities on listed companies. Moreover, securities are listed only when the exchange authorities are satisfied as regards legality and solvency of company concerned. Such scrutiny (detailed checking) avoids listing, of securities of unsound companies (i.e companies with bad financial status).

Services given by Stock Exchange to Companies ↓

Services given by Stock Exchange to Companies ↓

- Widens market for securities : Stock exchange widens the market for the listed securities and enables the companies to collect capital for promotion, expansion and modernization purpose. It indirectly provides financial support to companies / corporations.

- Creates goodwill and reputation : Stock exchange enhances the goodwill and the reputation of the companies whose securities are listed. Listing acts as a charater certificate given to a company. It gives prestigious position to company.

- Facilitates fair pricing of listed securities : The market price of listed securities tends to be slightly higher in relation to earnings and property values.

- Provides better response from investors : Listed securities get better response from the investor due to safety and security. Listing of securities is a unique service which stock exchanges offer to companies. It is a moral support given to stable companies.

- Facilitates quick selling of securities : Stock exchange enables companies to sell their securities easily and quickly. This is natural as investors always prefer to invest money in listed securities.

Service given by Stock Exchange to Economy ↓

Service given by Stock Exchange to Economy ↓

- Brings economic development : Stock exchanges brings rapid economic development through mobilization of funds for productive purposes. This facilitates the process of economic growth.

Role Functions of SEBI in Monitoring the Stock Exchange

What is SEBI?

What is SEBI?

Securities and Exchange Board of India (SEBI) is an apex body for overall development and regulation of the securities market. It was set up on April 12, 1988. To start with, SEBI was set up as a non-statutory body. Later on it became a statutory body under the Securities Exchange Board of India Act, 1992. The Act entrusted SEBI with comprehensive powers over practically all the aspects of capital market operations.

Picture of SEBI Bhavan in Mumbai. Image Credits © Paul Noronha.

Role Functions of SEBI

Role Functions of SEBI

The role or functions of SEBI are discussed below.

- To protect the interests of investors through proper education and guidance as regards their investment in securities. For this, SEBI has made rules and regulation to be followed by the financial intermediaries such as brokers, etc. SEBI looks after the complaints received from investors for fair settlement. It also issues booklets for the guidance and protection of small investors.

- To regulate and control the business on stock exchanges and other security markets. For this, SEBI keeps supervision on brokers. Registration of brokers and sub-brokers is made compulsory and they are expected to follow certain rules and regulations. Effective control is also maintained by SEBI on the working of stock exchanges.

- To make registration and to regulate the functioning of intermediaries such as stock brokers, sub-brokers, share transfer agents, merchant bankers and other intermediaries operating on the securities market. In addition, to provide suitable training to intermediaries. This function is useful for healthy atmosphere on the stock exchange and for the protection of small investors.

- To register and regulate the working of mutual funds including UTI (Unit Trust of India). SEBI has made rules and regulations to be followed by mutual funds. The purpose is to maintain effective supervision on their operations & avoid their unfair and anti-investor activities.

- To promote self-regulatory organization of intermediaries. SEBI is given wide statutory powers. However, self-regulation is better than external regulation. Here, the function of SEBI is to encourage intermediaries to form their professional associations and control undesirable activities of their members. SEBI can also use its powers when required for protection of small investors.

- To regulate mergers, takeovers and acquisitions of companies in order to protect the interest of investors. For this, SEBI has issued suitable guidelines so that such mergers and takeovers will not be at the cost of small investors.

- To prohibit fraudulent and unfair practices of intermediaries operating on securities markets. SEBI is not for interfering in the normal working of these intermediaries. Its function is to regulate and control their objectional practices which may harm the investors and healthy growth of capital market.

- To issue guidelines to companies regarding capital issues. Separate guidelines are prepared for first public issue of new companies, for public issue by existing listed companies and for first public issue by existing private companies. SEBI is expected to conduct research and publish information useful to all market players (i.e. all buyers and sellers).

- To conduct inspection, inquiries & audits of stock exchanges, intermediaries and self-regulating organizations and to take suitable remedial measures wherever necessary. This function is undertaken for orderly working of stock exchanges & intermediaries.

- To restrict insider trading activity through suitable measures. This function is useful for avoiding undesirable activities of brokers and securities scams.

Functions of Stock Exchange - Main Functions In The Market

1. Continuous and ready market for securities

1. Continuous and ready market for securities

Stock exchange provides a ready and continuous market for purchase and sale of securities. It provides ready outlet for buying and selling of securities. Stock exchange also acts as an outlet/counter for the sale of listed securities.

2. Facilitates evaluation of securities

2. Facilitates evaluation of securities

Stock exchange is useful for the evaluation of industrial securities. This enables investors to know the true worth of their holdings at any time. Comparison of companies in the same industry is possible through stock exchange quotations (i.e price list).

3. Encourages capital formation

3. Encourages capital formation

Stock exchange accelerates the process of capital formation. It creates the habit of saving, investing and risk taking among the investing class and converts their savings into profitable investment. It acts as an instrument of capital formation. In addition, it also acts as a channel for right (safe and profitable) investment.

4. Provides safety and security in dealings

4. Provides safety and security in dealings

Stock exchange provides safety, security and equity (justice) in dealings as transactions are conducted as per well defined rules and regulations. The managing body of the exchange keeps control on the members. Fraudulent practices are also checked effectively. Due to various rules and regulations, stock exchange functions as the custodian of funds of genuine investors.

5. Regulates company management

5. Regulates company management

Listed companies have to comply with rules and regulations of concerned stock exchange and work under the vigilance (i.e supervision) of stock exchange authorities.

6. Facilitates public borrowing

6. Facilitates public borrowing

Stock exchange serves as a platform for marketing Government securities. It enables government to raise public debt easily and quickly.

7. Provides clearing house facility

7. Provides clearing house facility

Stock exchange provides a clearing house facility to members. It settles the transactions among the members quickly and with ease. The members have to pay or receive only the net dues (balance amounts) because of the clearing house facility.

8. Facilitates healthy speculation

8. Facilitates healthy speculation

Healthy speculation, keeps the exchange active. Normal speculation is not dangerous but provides more business to the exchange. However, excessive speculation is undesirable as it is dangerous to investors & the growth of corporate sector.

9. Serves as Economic Barometer

9. Serves as Economic Barometer

Stock exchange indicates the state of health of companies and the national economy. It acts as a barometer of the economic situation / conditions.

10. Facilitates Bank Lending

10. Facilitates Bank Lending

Banks easily know the prices of quoted securities. They offer loans to customers against corporate securities. This gives convenience to the owners of securities.

What is Stock Exchange? Meaning Definitions and Features

What is Stock Exchange? Meaning

What is Stock Exchange? Meaning

Stock Exchange (also called Stock Market or Share Market) is one important constituent of capital market. Stock Exchange is an organized market for the purchase and sale of industrial and financial security. It is convenient place where trading in securities is conducted in systematic manner i.e. as per certain rules and regulations.

It performs various functions and offers useful services to investors and borrowing companies. It is an investment intermediary and facilitates economic and industrial development of a country.

Image Credits © Niyantha

Stock exchange is an organized market for buying and selling corporate and other securities. Here, securities are purchased and sold out as per certain well-defined rules and regulations. It provides a convenient and secured mechanism or platform for transactions in different securities. Such securities include shares and debentures issued by public companies which are duly listed at the stock exchange, and bonds and debentures issued by government, public corporations and municipal and port trust bodies.

Stock exchanges are indispensable for the smooth and orderly functioning of corporate sector in a free market economy. A stock exchange need not be treated as a place for speculation or a gambling den. It should act as a place for safe and profitable investment, for this, effective control on the working of stock exchange is necessary. This will avoid misuse of this platform for excessive speculation, scams and other undesirable and anti-social activities.

London stock exchange (LSE) is the oldest stock exchange in the world. While Bombay stock exchange (BSE) is the oldest in India. Similar Stock exchanges exist and operate in large majority of countries of the world.

Definitions of Stock Exchange

Definitions of Stock Exchange

According to Husband and Dockerary,

"Stock exchanges are privately organized markets which are used to facilitate trading in securities."The Indian Securities Contracts (Regulation) Act of 1956, defines Stock Exchange as,

"An association, organization or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities."

Features of Stock Exchange

Features of Stock Exchange

Characteristics or features of stock exchange are:-

- Market for securities : Stock exchange is a market, where securities of corporate bodies, government and semi-government bodies are bought and sold.

- Deals in second hand securities : It deals with shares, debentures bonds and such securities already issued by the companies. In short it deals with existing or second hand securities and hence it is called secondary market.

- Regulates trade in securities : Stock exchange does not buy or sell any securities on its own account. It merely provides the necessary infrastructure and facilities for trade in securities to its members and brokers who trade in securities. It regulates the trade activities so as to ensure free and fair trade

- Allows dealings only in listed securities : In fact, stock exchanges maintain an official list of securities that could be purchased and sold on its floor. Securities which do not figure in the official list of stock exchange are called unlisted securities. Such unlisted securities cannot be traded in the stock exchange.

- Transactions effected only through members : All the transactions in securities at the stock exchange are effected only through its authorised brokers and members. Outsiders or direct investors are not allowed to enter in the trading circles of the stock exchange. Investors have to buy or sell the securities at the stock exchange through the authorised brokers only.

- Association of persons : A stock exchange is an association of persons or body of individuals which may be registered or unregistered.

- Recognition from Central Government : Stock exchange is an organised market. It requires recognition from the Central Government.

- Working as per rules : Buying and selling transactions in securities at the stock exchange are governed by the rules and regulations of stock exchange as well as SEBI Guidelines. No deviation from the rules and guidelines is allowed in any case.

- Specific location : Stock exchange is a particular market place where authorised brokers come together daily (i.e. on working days) on the floor of market called trading circles and conduct trading activities. The prices of different securities traded are shown on electronic boards. After the working hours market is closed. All the working of stock exchanges is conducted and controlled through computers and electronic system.

- Financial Barometers : Stock exchanges are the financial barometers and development indicators of national economy of the country. Industrial growth and stability is reflected in the index of stock exchange.

Recurring Deposit Account In Bank - Meaning and Features

What is Recurring Deposit Account ? Meaning ↓

What is Recurring Deposit Account ? Meaning ↓

Recurring deposit account is generally opened for a purpose to be served at a future date. Generally opened to finance pre-planned future purposes like, wedding expenses of daughter, purchase of costly items like land, luxury car, refrigerator or air conditioner, etc.

Image Credits © pamelalong

Recurring deposit account is opened by those who want to save regularly for a certain period of time and earn a higher interest rate.

In recurring deposit account certain fixed amount is accepted every month for a specified period and the total amount is repaid with interest at the end of the particular fixed period.

Features of Recurring Deposit Account ↓

Features of Recurring Deposit Account ↓

The main features of recurring deposit account are as follows:-

- The main objective of recurring deposit account is to develop regular savings habit among the public.

- In India, minimum amount that can be deposited is Rs.10 at regular intervals.

- The period of deposit is minimum six months and maximum ten years.

- The rate of interest is higher.

- No withdrawals are allowed. However, the bank may allow to close the account before the maturity period.

- The bank provides the loan facility. The loan can be given upto 75% of the amount standing to the credit of the account holder.

Advantage of Recurring Deposit Account ↓

Advantage of Recurring Deposit Account ↓

The advantages of recurring deposit account are as follows:-

- Recurring deposit encourages regular savings habit among the people.

- Recurring deposit account holder can get a loan facility.

- The bank can utilise such funds for lending to businessmen.

- The bank may also invest such funds in profitable areas.

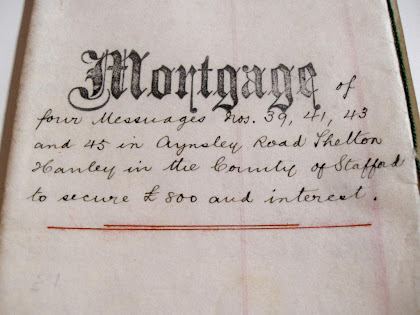

Essentials of Mortgage - Rights of Mortgagor - Mortgage Loans

Definition of Mortgage

Definition of Mortgage

A mortgage is the transfer of an interest in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, and existing or future debt or the performance of an engagement which may give rise to a pecuniary liability.

Image Credits © Rev Dan Catt

Parties & Terms Involved In A Mortgage

Parties & Terms Involved In A Mortgage

- Mortgage : A temporary loan secured (or money borrowed) from a creditor by keeping one's (owned) valuable property (e.g. House, Land, etc) as a mortgage security in order to give creditor an assurance for the repayment of debt within fixed time period.

- Mortgagor : The transferor or the one who makes/gives the mortgage is called a mortgagor.

- Mortgagee : The transferee or the one to whom mortgage is given or the one who takes/accepts the mortgage is called a mortgagee.

- Mortgage Aggrement : The legal document specifying terms, conditions, duties and obligations of parties involved in a mortgage contract is called Mortgage aggrement.

- Mortgage Money : The principal money and interest of which payment is secured for the time being are called the mortgage money.

- Mortgage Deed : The instrument (if any) by which the transfer is effected is called a mortgage deed.

Essentials of a Mortgage

Essentials of a Mortgage

- Specify immovable property : A mortgage is that the immovable property must be distinctly specified.

- Consideration : The consideration of a mortgage may be either :-

- The performance of a contract giving rise to a pecuniary liability,

- money advanced or to be advanced by way of loan, or

- an existing or future debt.

- Transfer of an interest : According to the

definition given above the third requisite of mortgage is that there

should be a "transfer of an interest" of an immovable property for the

purpose of securing the payment of money advanced by way of loan or for

the purpose of securing the performance.

The words "transfer of interest" signify that the interest which passes to the mortgage is not ownership or dominion, which notwithstanding the mortgage, resides in the mortgagor. This right is only an accessory right which is intended merely to secure the due payment of the debt. In mortgage, there is a transfer of a partial interest. - Parties : The person who transfers an interest in the property is called the mortgagor, the person to whom the interest is transferred is called the mortgagee. The mortgagor must be competent to transfer. Thus a minor cannot be a mortgagor but a minor can be a mortgagee.

Rights of the Mortgagor

Rights of the Mortgagor

- The Right of Redemption : or simply,

'The Right of Redemption'. The mortgagor is supposed to be the natural

owner of the property and hence it is accepted that his interests in the

property are always supposed to be natural. His rights are supposed to

be statutory and legal for which legal remedies are available for him to

establish his rights at the end.

At any time after the principal money has become due, the mortagor has a right, on payment or tender, at a proper time and place, of the mortgage money to require the mortgagee :-- to deliver to the mortgagor the mortagage deed and all documents relating to the mortgaged property which are in the possession or power of the mortagagee.

- Where the mortgagee, is in possession of the mortgaged property, to deliver possession thereof to the mortgagor.

- Re-transfer Case : He being, the natural owner of

the property has the inherent right to re-transfer his property to

anybody else irrespective of the person in whose favour he has firstly

transferred the property for the sake of money.

In other words, at the cost of the mortgagor either to re-transfer the mortgaged property to him or to such third person as he may direct, or to execute and (where the mortgage has been effected by a registered instrument) to have registered an acknowledgment in writing that any right in derogation of his interest to the mortgage has been extinguished. - Right to Grant Lease : It should also be not treated that after mortgaging the property the mortgagor is not free to lease the property to any of the lease. We have noted that mortgage implied the temporary charge over the immovable property belonging to the mortgagor till the money taken is repaid to the mortgagor. It is, therefore, the inherent right of the mortgager to make the lease of the property whenever he desires for any purpose. Each such lease is supposed to be binding on the mortgagee.

- Right of Inspection of the property : Since the mortgager is the natural owner of the property it is supposed to be his inherent right to inspect the property at any time and as and when he desires. It is his right to ascertain whether the property mortgaged is maintained properly or not and hence this right has been conferred on by the law itself. He can also ask for the documents of the property and is also eligible to get the copies of the documents.

- Right of Reasonable Wastages : The right of reasonable wastages is also guaranteed by the law but it is to be noted that such of the wastages are minimum and reasonable and does not affect the property in any way or does not cause any destruction or the injury to the property of a permanent nature.

- Right of Accession : It should not be supposed that

on transfer, due to mortgage, the right of the mortgagor extinguished

with regards to the property so mortgaged.

But the mortgagor has the right to access into the property at any time.

Such of the accession or the addition in the property can be possible on variety of occasions such as in the case of usufructuary mortgage for the improvement of the property or at the time of renewal of the lease of the mortgaged property for further period.

Scaling

scaling is the

process of measuring or

ordering entities with respect to quantitative attributes or traits. For

example, a scaling technique might involve estimating individuals' levels of

extraversion, or the perceived quality of products. Certain methods of scaling

permit estimation of magnitudes on a continuum,

while other methods provide only for relative ordering of the entities.

Types of Scales : Most frequently used Scales

1.

Nominal

Scale b. Ordinal

Scale c. Interval

Scale e. Ratio

Scale

Self Rating Scales

1.

Graphic

Rating Scale

2.

Itemized

Rating Scales

a.

Likert

Scale b. Semantic

Differential Scale c. Stapel’s

Scale d. Multi

Dimensional Scaling

b.

e.Thurston

Scales f. Guttman

Scales/Scalogram Analysis g.The

Q Sort technique

Four types of scales are generally used for Marketing

Research.

1. Nominal Scale

This is a

very simple scale. It consists of assignment of facts/choices to various

alternative categories which are usually exhaustive as well mutually exclusive.

These scales are just numerical and are the least restrictive of all the

scales. Instances of Nominal Scale are - credit card numbers, bank account

numbers, employee id numbers etc. It is simple and widely used when

relationship between two variables is to be studied. In a Nominal Scale numbers

are no more than labels and are used specifically to identify different

categories of responses. Following example illustrates -

What is

your gender? [ ] Male

[ ] Female

Another

example is - a survey of retail stores done on two dimensions - way of

maintaining stocks and daily turnover.

How do you

stock items at present?

[ ] By product category [ ] At a centralized store [ ] Department wise [ ] Single warehouse

[ ] By product category [ ] At a centralized store [ ] Department wise [ ] Single warehouse

Daily

turnover of consumer is?

[ ] Between 100 – 200 [ ] Between 200 – 300 [ ] Above 300

[ ] Between 100 – 200 [ ] Between 200 – 300 [ ] Above 300

A two way

classification can be made as follows

Daily/Stock Turnover Method

|

Product Category

|

Department wise

|

Centralized Store

|

Single Warehouse

|

100 – 200

|

||||

200 – 300

|

||||

Above 300

|

1. Ordinal Scale

Ordinal

scales are the simplest attitude measuring scale used in Marketing

Research. It is more powerful than a nominal scale in that the numbers

possess the property of rank order. The ranking of certain product

attributes/benefits as deemed important by the respondents is obtained through

the scale.

Example 1: Rank the following attributes (1 – 5), on their importance in a

microwave oven.

a.

Company Name b. Functions

c. Price d.Comfort e.Design

The most

important attribute is ranked 1 by the respondents and the least important is

ranked 5. Instead of numbers, letters or symbols too can be used to rate in a

ordinal scale. Such scale makes no attempt to measure the degree of

favourability of different rankings.

Example 2 – If there are 4 different types of fertilizers and if they are

ordered on the basis of quality as Grade A, Grade B, Grade C, Grade D is again

an Ordinal Scale.

Example 3 – If there are 5 different brands of Talcom Powder and if a

respondent ranks them based on say, “Freshness” into Rank 1 having maximum

Freshness Rank 2 the second maximum Freshness, and so on, an Ordinal Scale

results.

2. Interval Scale

Herein the

distance between the various categories unlike in Nominal, or numbers unlike in

Ordinal, are equal in case of Interval Scales. The Interval Scales are also

termed as Rating Scales. An Interval Scale has an arbitrary Zero point with

further numbers placed at equal intervals. A very good example of Interval

Scale is a Thermometer.

Illustration

1 – How do

you rate your present refrigerator for the following qualities.

Company Name

|

Less Known

|

1

|

2

|

3

|

4

|

5

|

Well Known

|

Functions

|

Few

|

1

|

2

|

3

|

4

|

5

|

Many

|

Price

|

Low

|

1

|

2

|

3

|

4

|

5

|

High

|

Design

|

Poor

|

1

|

2

|

3

|

4

|

5

|

Good

|

Overall Satisfaction

|

Very Dis-Satisfied

|

1

|

2

|

3

|

4

|

5

|

Very Satisfied

|

Such a

scale permits the researcher to say that position 5 on the scale is above

position 4 and also the distance from 5 to 4 is same as distance from 4 to 3.

Such a scale however does not permit conclusion that position 4 is twice as

strong as position 2 because no zero position has been established. The data

obtained from the Interval Scale can be used to calculate the Mean scores of

each attributes over all respondents. The Standard Deviation (a measure of

dispersion) can also be calculated.

1. Ratio Scale

Ratio

Scales are not widely used in Marketing

Research unless a base item

is made available for comparison. In the above example of Interval scale, a

score of 4 in one quality does not necessarily mean that the respondent is

twice more satisfied than the respondent who marks 2 on the scale. A Ratio

scale has a natural zero point and further numbers are placed at equally

appearing intervals. For example scales for measuring physical quantities like

– length, weight, etc.

The ratio

scales are very common in physical scenarios. Quantified responses forming a

ratio scale analytically are the most versatile. Rati scale possess all he

characteristics of an internal scale, and the ratios of the numbers on these

scales have meaningful interpretations. Data on certain demographic or

descriptive attributes, if they are obtained through open-ended questions, will

have ratio-scale properties. Consider the following questions :

Q 1) What

is your annual income before taxes? ______ $

Q 2) How far is the Theater from your home ? ______ miles

Q 2) How far is the Theater from your home ? ______ miles

Answers to

these questions have a natural, unambiguous starting point, namely zero. Since

starting point is not chosen arbitrarily, computing and interpreting ratio

makes sense. For example we can say that a respondent with an annual income of

$ 40,000 earns twice as much as one with an annual income of $ 20,000.

Self rating scales

1. Graphic Rating Scale

The

respondents rate the objects by placing a mark at the appropriate position on a

line that runs from one extreme of the criterion variable to another. Example

0

(poor quality) |

1

(bad quality) |

5

(neither good nor bad) |

7

(good quality) |

BRAND 1

This is

also known as continuous rating scale. The customer can occupy any position.

Here one attribute is taken ex-quality of any brand of icecream.

poor

|

good

|

BRAND 2

This line

can be vertical or horizontal and scale points may be provided. No other

indication is there on the continuous scale. A range is provided. To quantify

the responses to question that “indicate your overall opinion about ice-ream

Brand 2 by placing a tick mark at appropriate position on the line”, we measure

the physical distance between the left extreme position and the response

position on the line.; the greater the distance, the more favourable is the

response or attitude towards the brand.

Its

limitation is that coding and analysis will require substantial amount of time,

since we first have to measure the physical distances on the scale for each

respondent.

1. Itemized Rating Scales

These

scales are different from continuous rating scales. They have a number of brief

descriptions associated with each category. They are widely used in Marketing

Research. They essentially take the form of the multiple category

questions. The most common are – Likert, Sementic, Staple and Multiple

Dimension. Others are – Thurston and Guttman.

a. Likert Scale

It was

developed Rensis Likert. Here the respondents are asked to indicate a degree of

agreement and disagreement with each of a series of statement. Each scale item

has 5 response categories ranging from strongly agree and strongly disagree.

5

Strongly agree |

4

Agree |

3

Indifferent |

2

Disagree |

1

Strongly disagree |

Each

statement is assigned a numerical score ranging from 1 to 5. It can also be

scaled as -2 to +2.

-2

|

-1

|

0

|

1

|

2

|

For

example quality of Mother Diary ice-cream is poor then Not Good is a negative

statement and Strongly Agree with this means the quality is not good.

Each

degree of agreement is given a numerical score and the respondents total score

is computed by summing these scores. This total score of respondent reveals the

particular opinion of a person.

Likert

Scale are of ordinal type, they enable one to rank attitudes, but not to

measure the difference between attitudes. They take about the same amount of

efforts to create as Thurston scale and are considered more discriminating and

reliable because of the larger range of responses typically given in Likert

scale.

A typical

Likert scale has 20 – 30 statements. While designing a good Likert Scale, first

a large pool of statements relevant to the measurement of attitude has to be

generated and then from the pool statements, the statements which are vague and

non-discriminating have to be eliminated.

a. Semantic Differential Scale

This is a

seven point scale and the end points of the scale are associated with bipolar

labels.

1

Unpleasant Submissive |

2

|

3

|

4

|

5

|

6

|

7

Pleasant Dominant |

Suppose we

want to know personality of a particular person. We have options-

a.

Unpleasant/Submissive

b.

Pleasant/Dominant

Bi-polar

means two opposite streams. Individual can score between 1 to 7 or -3 to 3. On the basis of these

responses profiles are made. We can analyse for two or three products and by

joining these profiles we get profile analysis. It could take any shape

depending on the number of variables.

Mean and median are used for comparison. This scale

helps to determine overall similarities and differences among objects.

When

Semantic Differential Scale is used to develop an image profile, it provides a

good basis for comparing images of two or more items. The big advantage of this

scale is its simplicity, while producing results compared with those of the

more complex scaling methods. The method is easy and fast to administer, but it

is also sensitive to small differences in attitude, highly versatile, reliable

and generally valid.

b. Stapel’s Scale

It was

developed by Jan Stapel. This scale has some distinctive features:-

a.

Each item has only one word/phrase indicating the dimension it

represents.

b.

Each item has ten response categories.

c.

Each item has an even number of categories.

d.

The response categories have numerical labels but no verbal

labels.

For

example, in the following items, suppose for quality of ice cream, we ask

respondents to rank from +5 to -5. Select a plus number for words which best

describe the ice cream accurately. Select a minus number for words you think do

not describe the ice cream quality accurately. Thus, we can select any number

from +5,for words we think are very accurate, to -5,for words we think are very

inaccurate. This scale is usually presented vertically.

+5 +4

+3 +2 +1

High Quality

-1 -2 -3 -4 -5

High Quality

-1 -2 -3 -4 -5

This is a

unipolar rating scale.

c. Multi Dimensional Scaling

It

consists of a group of analytical techniques which are used to study consumer

attitudes related to perceptions and preferences. It is used to study-

a.

The major attributes of a given class of products perceivedby the

consumers in considering the product and by which they compare the different ranks.

b.

To study which brand competes most directly with each other.

c.

To find out whether the consumers would like a new brand with a

combination of characteristics not found in the market.

d.

What would be the consumers ideal combination of product

attributes.

e.

What sales and advertising messages are compatible with consumers

brand perceptions.

It is a

computer based technique. The respondents are asked to place the various brands

into different groups like similar, very similar, not similar, and so on. A

goodness of fit is traded off on a large number of attributes. Then a lack of

fit index is calculated by computer program. The purpose is to find a

reasonably small number of dimensions which will eliminate most of the stress.

After the configuration for the consumer’s preference has been developed, the

next step is to determine the preference with regards to the product under

study. These techniques attempt to identify the product attributes that are

important to consumers and to measure their relative importance.

This

scaling involves a unrealistic assumption that a consumer who compares

different brands would perceive the differences on the basis of only one

attribute.For example, what are the attributes for joining M.Com course. The

responses may be –to do PG, to go into teaching line,to get knowledge,

appearing in the NET. There are a number of attributes, you can not base

decision on one attribute only. Therefore, when the consumers are choosing

between brands, they base their decision on various attributes. In practice,

the perceptions of the consumers involve different attributes and any one

consumer perceives each brand as a composite of a number of different

attributes. This is a shortcoming of this scale.

Whenever

we choose from a number of alternatives, go for multi- dimensional scaling.

There are many possible uses of such scaling like in market segmentation,

product life cycle, vendor evaluations and advertising media selection.

The

limitation of this scale is that it is difficult to clearly define the concept

of similarities and preferences. Further the distances between the items are

seen as different

d. Thurston Scales

These are

also known as equal appearing interval scales. They are used to measure the

attitude towards a given concept or construct. For this purpose a large number

of statements are collected that relate to the concept or construct being

measured. The judges rate these statements along an 11 category scale in which

each category expresses a different degree of favourableness towards the concept.

The items are then ranked according to the mean or median ratings assigned by

the judges and are used to construct questionnaire of twenty to thirty items

that are chosen more or less evenly across the range of ratings. The statements

are worded in such a way so that a person can agree or disagree with them. The

scale is then administered to assemble of respondents whose scores are

determined by computing the mean or median value of the items agreed with. A

person who disagrees with all the items has a score of zero. So, the advantage

of this scale is that it is an interval measurement scale. But it is the time

consuming method and labour intensive. They are commonly used in psychology and

education research.

e. Guttman Scales/Scalogram Analysis

It is based

on the idea that items can be arranged along a continuem in such a way that a

person who agrees with an item or finds an item acceptable will also agree with

or find acceptable all other items expressing a less extreme position. For

example – Children should not be allowed to watch indecent programmes or

government should ban these programmes or they are not allowed to air on the

television. They all are related to one aspect.

In this

scale each score represents a unique set of responses and therefore the total

score of every individual is obtained. This scale takes a lot of time and

effort in development.

They are

very commonly used in political science, anthropology, public opinion, research

and psychology.

f. The Q Sort technique

It is used

to discriminate among large number of objects quickly. It uses a rank order

procedure and the objects are sorted into piles based on similarity with

respect to some criteria. The number of objects to be sorted should be between

60-140 approximately. For example, here we are taking nine brands. On the basis

of taste we classify the brands into tasty, moderate and non tasty.

We can

classify on the basis of price also-Low, medium, high. Then we can attain the

perception of people that whether they prefer low priced brand, high or

moderate. We can classify sixty brands or pile it into three piles. So the

number of objects is to be placed in three piles-low, medium or high.

Thus, the

Q-sort technique is an attempt to classify subjects in terms of their

similarity to attribute under study.

Subscribe to:

Posts (Atom)